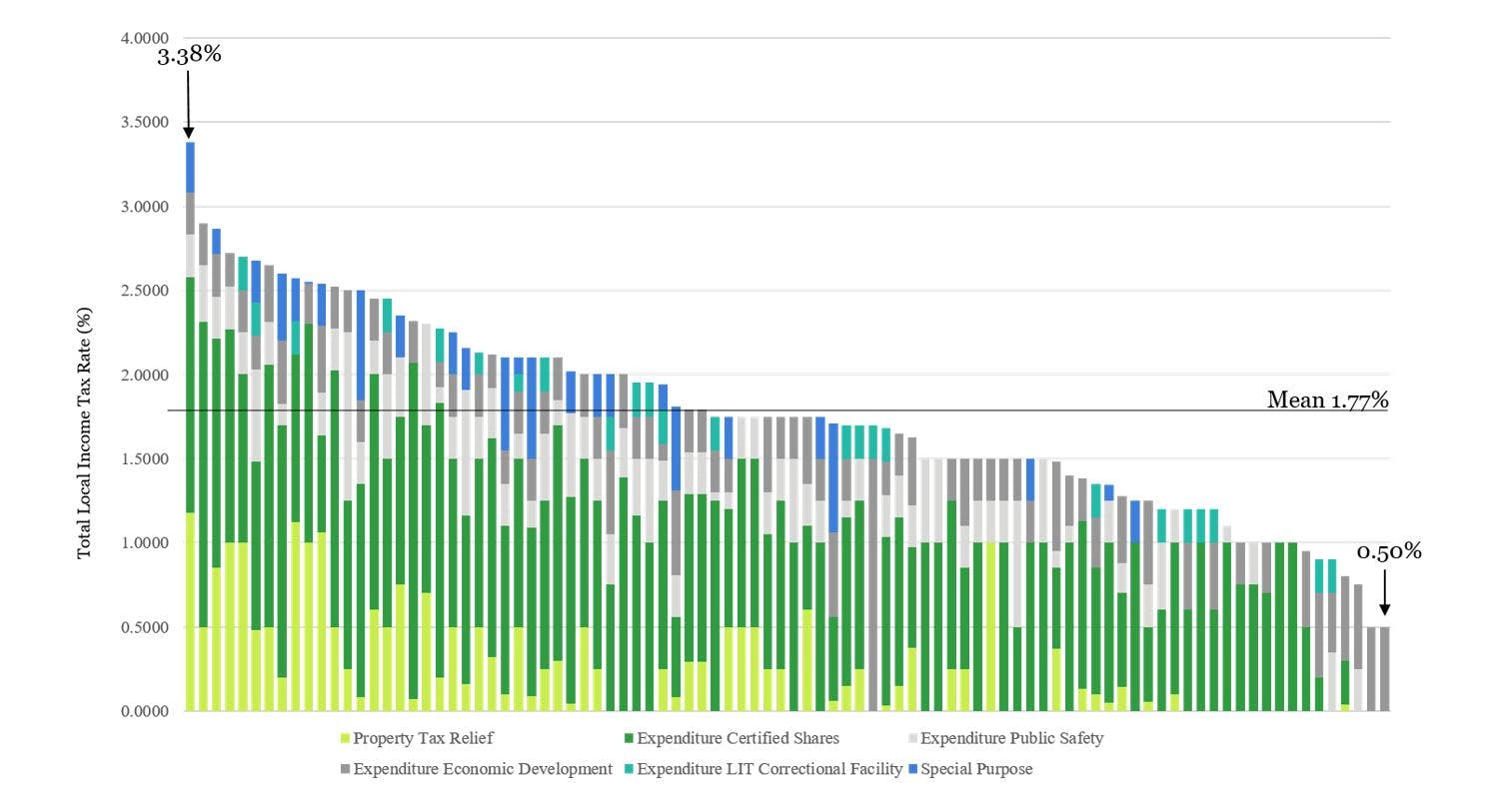

Indiana Local Income Tax Rates 2025. Each county has one county income tax rate (i.e., tax rates are the same for residents and nonresidents). We have information on the local income tax rates in 91 localities in indiana.

As of 2025, the highest county income tax rate. The salary tax calculator for indiana income tax calculations.

The indiana department of revenue (dor) keeps comprehensive records of county tax rates, dating back to 2007.

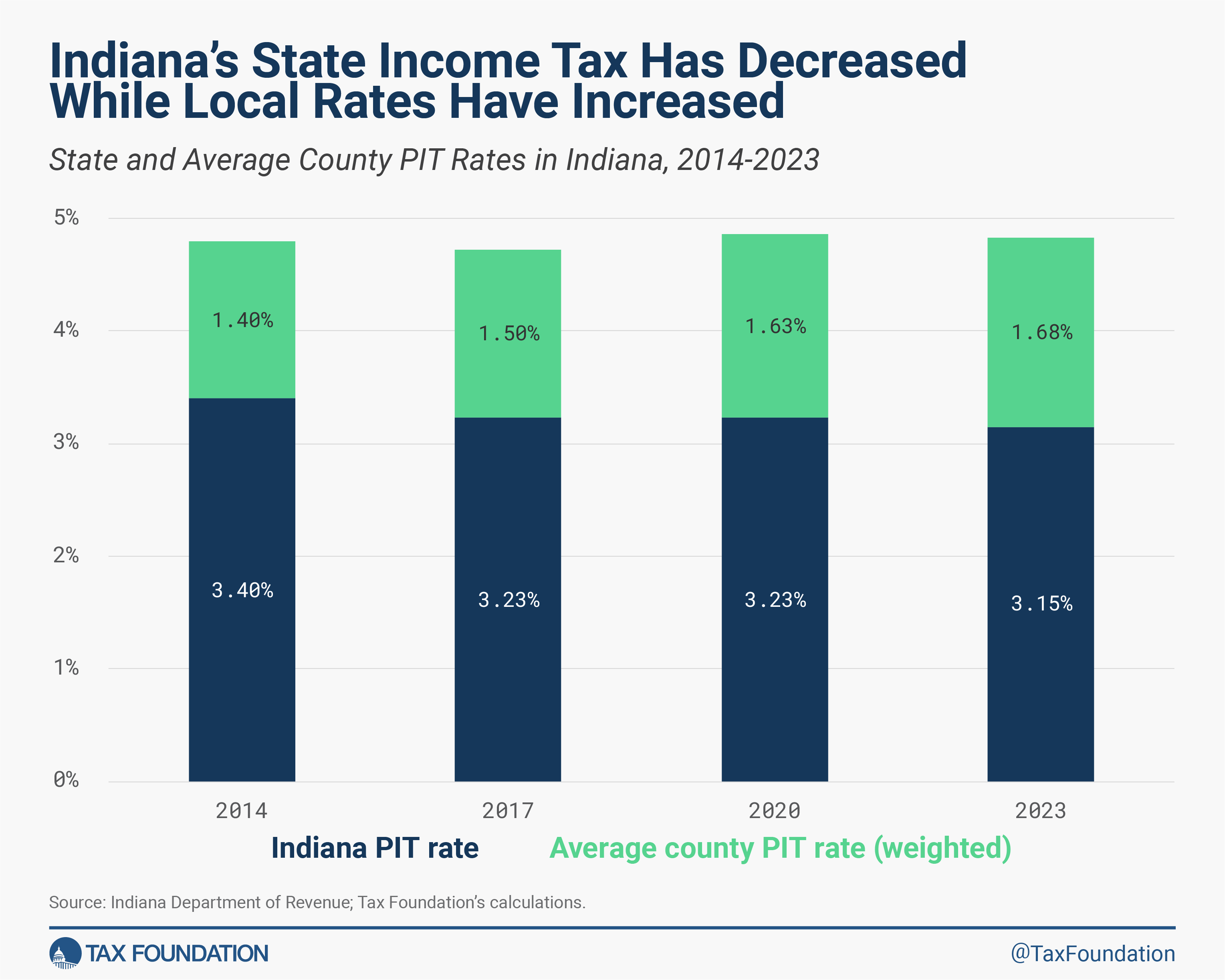

Indiana Local Taxes Compatible with State Tax Reform, As of 2025, the highest county income tax rate. Indiana has a flat tax rate of 3.23% for 2025, meaning everyone pays the same state income tax regardless of their income.

Strategy to Fund Regional Infrastructure ppt download, The indiana individual adjusted gross income tax rate for 2025 is 3.15% and will adjust in 2025 to 3.05%. ( indiana departmental notice no.

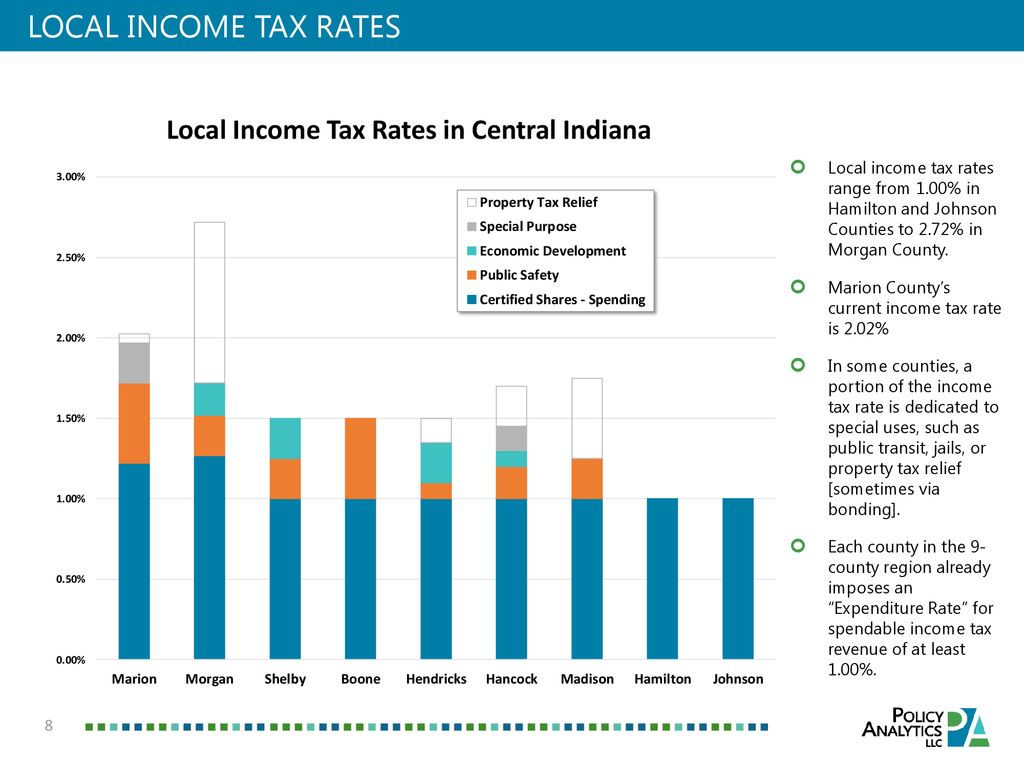

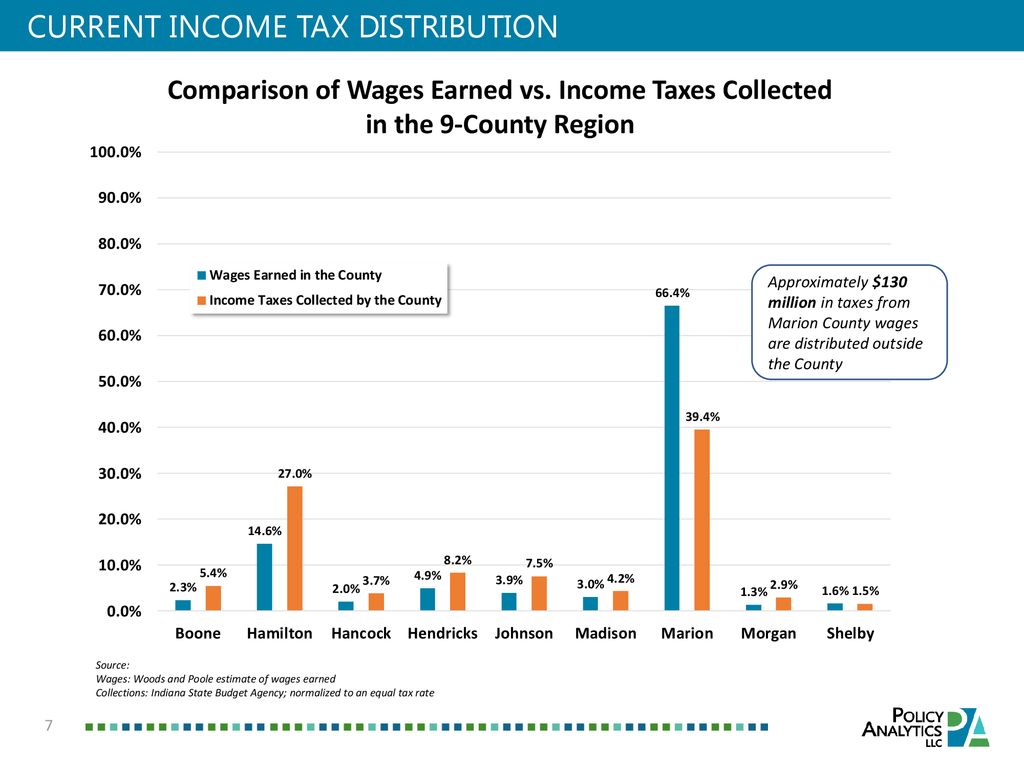

Strategy to Fund Regional Infrastructure ppt download, The table below shows the income tax rates for all 92 indiana counties. Calculated using the indiana state tax tables and allowances for 2025 by selecting your filing status and entering your income for 2025 for.

Nearly of Indiana counties adjust local tax rates for, County income tax rates may be adjusted in january. Employers withhold state and county income taxes from employees’.

Local Taxes in 2019 Local Tax City & County Level, Income tax tables and other tax information is sourced from the indiana department of. The table below shows the income tax rates for all 92 indiana counties.

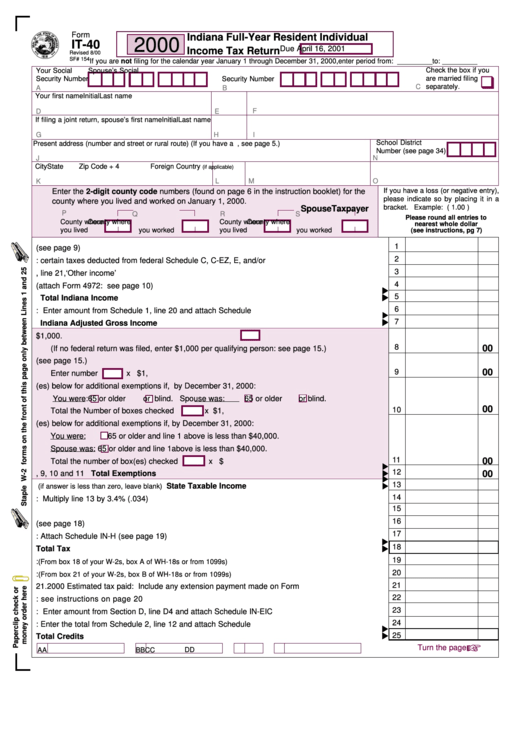

Indiana County Tax Form, Calculate your county tax by year. Dor ha traducido la siguiente información para beneficio de nuestros clientes de habla español.

Individual tax rates rise in Johnson, 4 other counties Local, Local income tax rates are determined by county officials and provided to the dor for review and release. For tax years beginning after december 31, 2025,.

Individual Tax Rates to Rise in Three Indiana Counties Effective, ( indiana departmental notice no. Indiana's individual income tax rate will go from 3.15 percent to 3.05 percent in 2025 as part of an acceleration of income tax cuts passed in 2025.

13 Smart MoneySaving YearEnd Tax Moves To Make, Indiana state income tax calculation: The indiana department of revenue (dor) keeps comprehensive records of county tax rates, dating back to 2007.

Individual tax Rates to rise in 5 Indiana counties, including, You can click on any city or county for more details, including the nonresident income tax rate and tax forms. Dor guia de servicios para contribuyentes.

Local income tax rates are determined by county officials and provided to the dor for review and release.